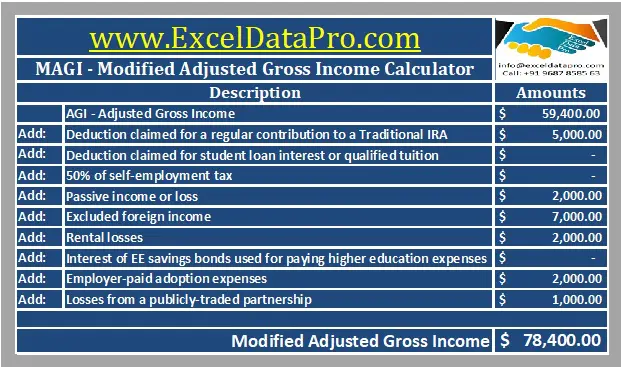

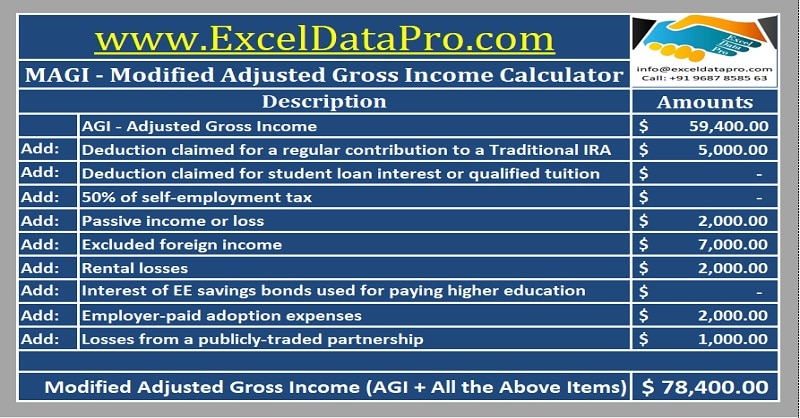

Magi calculator 2020

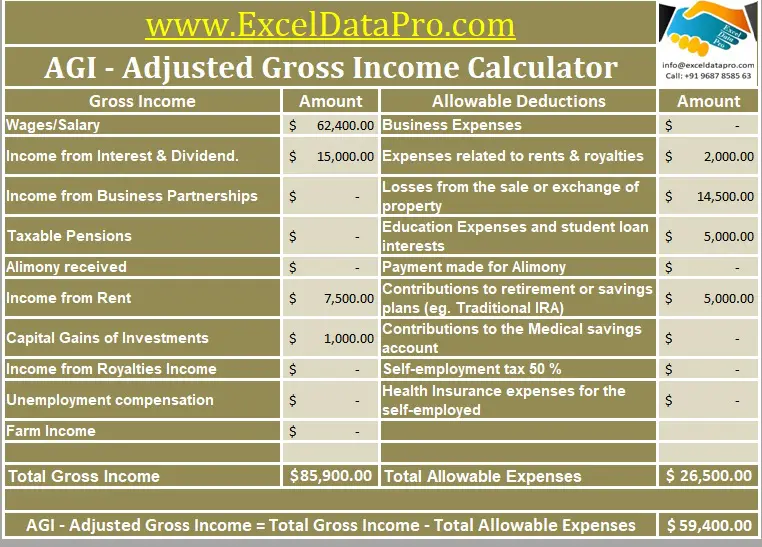

For many people MAGI is identical or very. You can calculate your AGI for the year using the following formula.

Agi Calculator Adjusted Gross Income Calculator

The beneficiarys adjusted gross income AGI found on line 11 of the Internal Revenue Service IRS tax filing form 1040 plus.

. MAGI is calculated by adding back several deductions to your. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. As per today there are specific cases in which the tax calculations are based on a modified adjusted gross income as defined within the law.

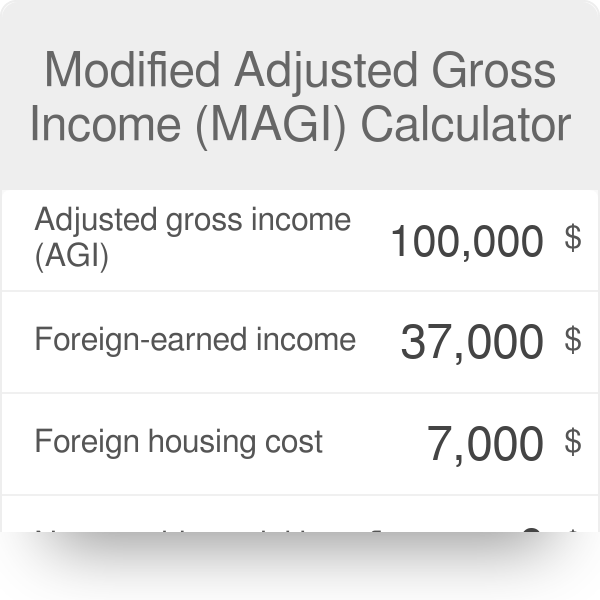

Whatever Your Investing Goals Are We Have the Tools to Get You Started. MAGI is adjusted gross income AGI plus these if any. AGI gross income adjustments to income.

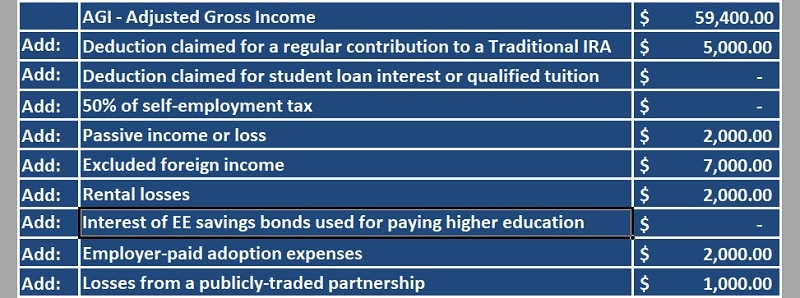

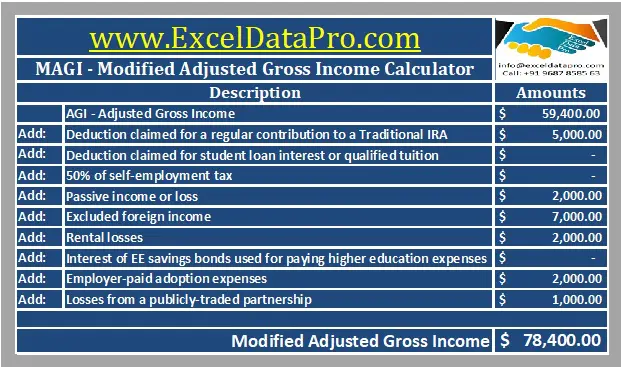

Modified Adjusted Gross Income Calculator is an excel sheet which helps you calculate your MAGI very easily and accurately. Employers and employees split the tax. For most taxpayers MAGI is adjusted gross income AGI as figured on their federal income tax return.

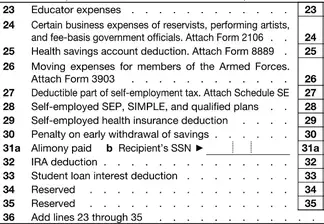

If you file Form 1040 or 1040-SR your MAGI is. In these cases there are items gross income. Modified Adjusted Gross Income MAGI Part B monthly premium amount.

The process of calculating the value of your MAGI is straightforward and it is enough to follow the following steps. In 2020 that maximum amount is 6000 for most individuals and 7000 for those at age fifty or older. How to Calculate Modified Adjusted Gross Income.

For a married couple and filing jointly the MAGI must be below 203000 and 206000 for 2019 and 2020 respectively. The Taxpayer Advocate Service has developed several tools for individuals and employers to help determine how the Affordable Care Act might affect them and to estimate. Calculate annual gross income.

Individuals with a MAGI of less than or equal to 91000. Untaxed foreign income non-taxable Social Security benefits and tax-exempt interest. It would be on page 1 look for line 4 Form 1040EZ Next to calculate your modified adjusted gross income MAGI take your AGI and add back certain deductions.

Prescription drug coverage monthly premium amount. So each party pays 765 of their. If your income falls between 124000 and 139000 or 196000 and.

For both of them the current Social Security and Medicare tax rates are 62 and 145 respectively. Calculate the value of. The ACA uses the term modified adjusted gross income MAGI to describe the way income would be calculated for premium subsidy eligibility and thats accurate.

Tax-exempt interest income line 2a of IRS. Gross income the sum of all the money you earn in a year. MAGI when using Form 1040 or 1040-SR.

Download Modified Adjusted Gross Income Calculator Excel Template Exceldatapro

Download Modified Adjusted Gross Income Calculator Excel Template Exceldatapro

Download Modified Adjusted Gross Income Calculator Excel Template Exceldatapro

Magi Calculation Irmaa And Premium Aca Tax Credits Fiphysician

Calculating Magi For Various Tax Credits And Deductions Wealth Meta

How To Calculate Modified Agi Howstuffworks

What Is Modified Adjusted Gross Income H R Block

Download Modified Adjusted Gross Income Calculator Excel Template Exceldatapro

Solved I Have To Calculate My Child S Magi From Her 1040 I Do Have The 1040 As She Has Filed Her Taxes But Instructions Say To Add Up Lines 2a 8b There

Irmaa Magi Traditional Ira And Sepira Bogleheads Org

Magi Income Chart Covered Ca Subsidies Tax Credits Fpl Poverty Level 2022

Magi Income Chart Covered Ca Subsidies Tax Credits Fpl Poverty Level 2022

Modified Adjusted Gross Income Magi

2021 Health Insurance Marketplace Calculator Kff

How To Calculate Magi Youtube

Download Modified Adjusted Gross Income Calculator Excel Template Exceldatapro

Magi Calculator What Is Magi